Trusted Corporate Compliance Partners

Company Compliance, Handled With Ease

We take care of all your filings, director info, and legal updates, so your company stays in shape while you focus on moving your business forward.

We take care of all your filings, director info, and legal updates, so your company stays in shape while you focus on moving your business forward.

We look after your legal, filing, and regulatory duties with sharp attention to detail. Stay worry-free, always ready for reviews, and confidently meet every deadline that matters.

Smart compliance for Private Limited Companies made easy. We manage ROC returns, board updates, annual filings, and give expert help when you need it.

Handle all LLP needs with care. We sort out Form 8, Form 11, and update your agreement so you never miss a deadline.

Running a One Person Company? We handle your yearly forms, director updates, and MCA needs with personal attention.

Change your business name the right way—get all MCA approvals, update your MOA/AOA, and make sure every government record reflects your new identity.

Relocating your office? We’ll take care of address updates, board meeting notes, utility proofs, and timely ROC notifications—so you don’t have to stress.

Need to file your DIR-3 KYC? Stay compliant and avoid penalties with our reminder system and smooth filing support, right on schedule.

From starting up to leveling up or shifting gears, we make sure your compliance stays in sync. Whether it’s just you or a team of directors, we provide made-to-fit ROC filings, director changes, and yearly packages—so your business stays right on track, every step of the way.

No more missing filings or facing legal issues. We’ve got the entire compliance chain covered — from DIN eKYC, ADT-1, and DPT-3 to director shifts, shareholder changes, and capital tweaks — all guided by trusted CA and CS experts.

Starting your company is just the beginning — we stick around long after that. Our team’s got your back all year with timely help on event-based filings, board resolutions, annual summaries, and smart compliance tips that match your business setup.

From start to finish — we take care of everything from setup to filing, so you stay stress-free while staying fully GST compliant.

Let trained experts manage your GST filings with care. They focus on accuracy, maximize your tax credits, and help you avoid expensive slip-ups. No more stress about missing due dates.

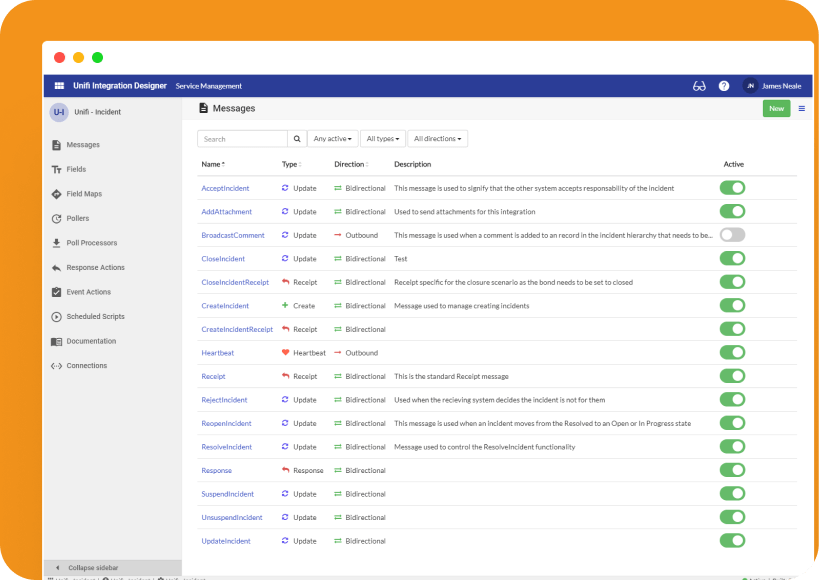

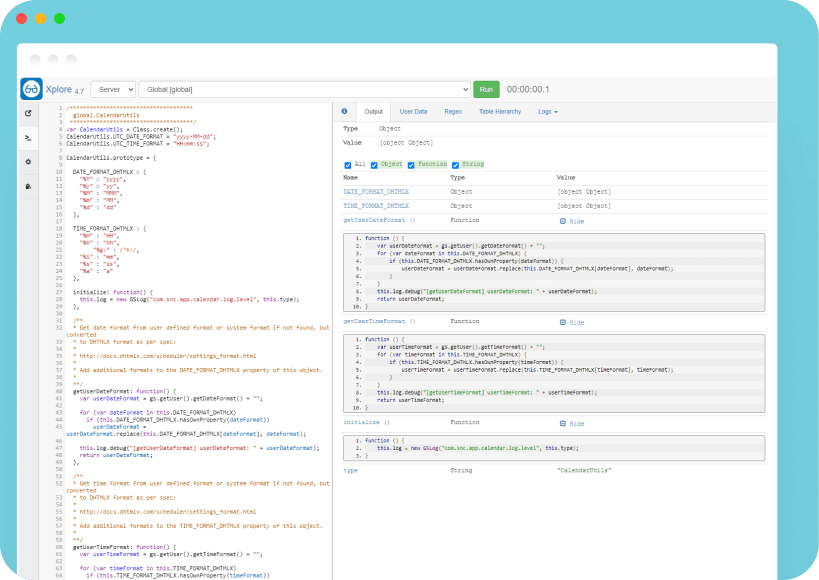

Everything is done online with top-grade protection, automatic checks, and live tracking — all in one place, without any confusion or back-and-forth.

From handling taxes to registering your venture and staying legally aligned — we manage it all, giving you time to expand and thrive.

Real voices from real people who found fast, dependable support and smart solutions for everything from taxes to compliance and business matters.

Find clear answers to common questions about annual filings, ROC compliance, director updates, and other essential company law requirements.

Company compliance refers to fulfilling all legal obligations under the Companies Act, 2013. This includes annual ROC filings, maintaining statutory registers, conducting board meetings, and filing event-based forms. Non-compliance can lead to heavy penalties, director disqualification, and legal trouble. Staying compliant also enhances investor trust and business credibility.

A company must file annually with the Registrar of Companies (ROC), typically in two parts: Form AOC-4 (financial statements) and MGT-7 (annual return). Additionally, specific events—like director changes, share transfers, or address updates—require separate filings. We manage this entire lifecycle on your behalf.

Yes. Late filing attracts a penalty of ₹100 per day per form, with no upper limit. This can accumulate to significant amounts and result in legal action. Our team ensures timely submission of all forms, including reminders and full support.

Yes. LLPs must file Form 11 (Annual Return) and Form 8 (Statement of Accounts). OPCs follow a similar pattern to private limited companies for annual ROC filings. Our packages are tailored to meet the distinct needs of each entity type, ensuring complete coverage.

DIN eKYC (DIR-3 KYC) is mandatory for all directors holding a Director Identification Number (DIN). It verifies identity and contact details annually. Non-filing results in DIN deactivation and a penalty of ₹5,000. We handle the form preparation, filing, and OTP verification process.

Yes. Changing the registered office involves filing INC-22 with supporting documentation (like utility bills or rental agreements). If the change is across states, it requires approval from the Regional Director. We manage the entire process from board resolution to final ROC update.

Adding or removing directors involves drafting resolutions, obtaining consent letters, updating DIR-12 on the MCA portal, and updating internal registers. We ensure that all steps are legally compliant and properly documented for smooth transitions.

Form ADT-1 is used to intimate the ROC about the appointment of a company’s auditor. It must be filed within 15 days of the AGM in which the auditor is appointed. Failing to file can attract penalties and non-recognition of the audit in legal matters.

DPT-3 is a mandatory annual return filed by companies to disclose loan and deposit-related details. Even if your company has not accepted any public deposits, DPT-3 must be filed as a NIL return. We help determine your applicability and ensure correct filing.

Companies not actively carrying out business can file for dormant status under the Companies Act. This protects the legal existence without active compliance. Ideal for companies between projects or in hibernation. We help you transition and reactivate when ready.

From DIN eKYC to ADT-1, we handle everything — on time, every time.

Speak with an Expert – Fast, Trustworthy Help for Every Compliance Matter.

Guiding individuals and companies across India to stay clear on taxes. Skilled help with GST, Income Tax, and Starting Your Business.

©2025. Tax Aapka. All Rights Reserved.