Trusted Income Tax Experts

Easygoing Tax Filing by Skilled Experts

Whether it's your first return or a complex business file, our tax team keeps things simple, clear, and stress-free so you can breathe easy.

Whether it's your first return or a complex business file, our tax team keeps things simple, clear, and stress-free so you can breathe easy.

We take care of every step in your tax journey from filing to follow-ups with skill and care focusing on accuracy deadlines and helping you get the best refund possible.

E-file your income tax return with ease. Reviewed by expert CAs, it's quick, safe, and precise—perfect for individuals, professionals, and all types of businesses.

From salaried employees to freelancers, HUFs, firms, companies, and NGOs—we cover every tax form and filing need.

Need to send money abroad? Let our expert CAs handle your 15CA and 15CB forms the right way, so you stay compliant and worry-free.

Need to deduct TDS? We’ll help you get your TAN registered quickly and smoothly so your TDS filings stay on track and fully compliant with income tax rules.

We file your quarterly TDS returns on time—complete with accurate data checks, deduction reviews, and full compliance. Perfect for businesses, employers, and vendors.

We support audits for companies, NGOs, and trusts—ensuring you meet all tax requirements under sections like 44AB, 12A, and others of the Income Tax Act.

We secure your information using SSL locks, cloud firewalls, and globally approved ISO 27001 standards. Each login, document, and transaction is watched over with the same care banks use.

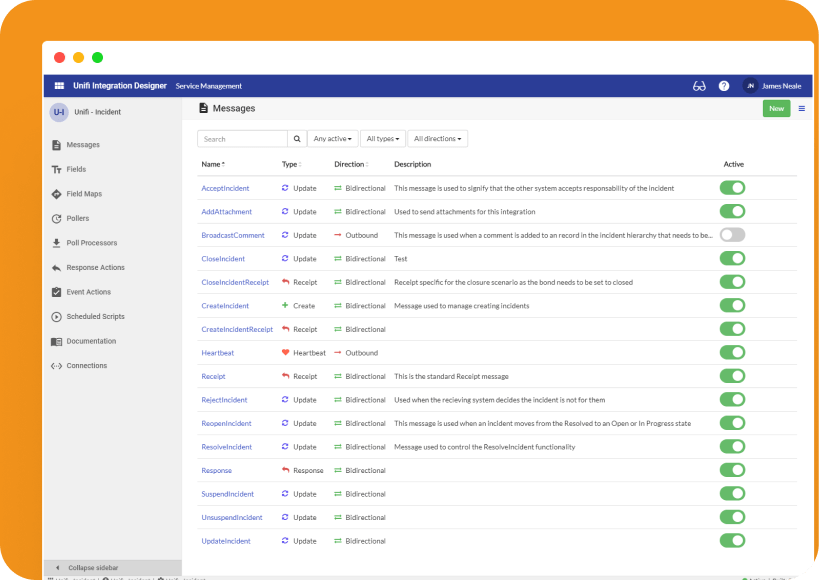

See every PAN-linked tax return in one clear view. Compare years, track refunds, catch notices, check deductions, and stay updated live

We grab Form 16, AIS, and Form 26AS directly from your email and tax portal—just for salaried clients. Stay worry-free with accurate records and no time lost on manual work.

No matter if you’re filing as a person or a company, count on us for accurate, timely ITRs — complete with CA guidance and full support throughout.

Begin your ITR filing smoothly and stress-free. It’s simple, accurate, and you’re never alone in the process.

Unsure about taxes? Speak with a trusted CA and get the right answers tailored to your situation.

We offer trusted expertise, safe processing, and spot-on filing, making tax season feel calm, clear, and completely hassle-free.

Real voices from real people who found fast, dependable support and smart solutions for everything from taxes to compliance and business matters.

Find clear answers to common questions about Income Tax filing, deductions, refunds, notices, and compliance—everything you need to file with confidence.

Anyone whose income exceeds the prescribed exemption limit must file a return. It also applies to companies, freelancers, NRIs, and those claiming tax refunds.

Each ITR form corresponds to a specific taxpayer type. We help you select the right one—from ITR-1 for salaried to ITR-6 for companies.

Yes. Even without Form 16, we can file using salary slips, AIS, and Form 26AS. We simplify the process for salaried and contract workers.

You’ll need PAN, Aadhaar, income details, bank accounts, and proof of deductions. For businesses, financials and ledgers may be required.

Yes. You cannot file returns unless your PAN is linked with Aadhaar. It’s a mandatory compliance requirement.

Usually 24–48 hours post-document submission. For complex or high-income cases, slightly more.

Absolutely. We specialize in NRI tax matters including DTAA benefits, global income, and Schedule FA filing.

If your business turnover or professional receipts cross specific thresholds, a tax audit becomes mandatory. We handle it end-to-end.

They are required for making foreign remittances. Form 15CB needs a CA’s digital signature. We handle these filings with ease.

You can file a belated return with penalties. Our team ensures it’s filed correctly to avoid notices or disallowances.

Yes. If filed before the deadline, it can be revised to fix errors. We help correct and resubmit it accurately.

We handle notice replies under various sections (139(9), 143(1), 148, etc.) with expert drafting, documentation, and representation.

No delays. No confusion. Just expert tax support for stress-free compliance

Speak with an Expert – Fast, Trustworthy Help for Every Compliance Matter.

Guiding individuals and companies across India to stay clear on taxes. Skilled help with GST, Income Tax, and Starting Your Business.

©2025. Tax Aapka. All Rights Reserved.